As seniors anticipate the overwhelming process of paying for college, the Free Application for Federal Student Aid (FAFSA) Simplification Act attempted to clarify the complexities of applying for financial aid, the Federal Student Aid (FSA) reported. However, following the soft launch of the redesigned FAFSA 2024-2025, countless issues filling out and accessing the form arose at South and around the country, FSA reported.

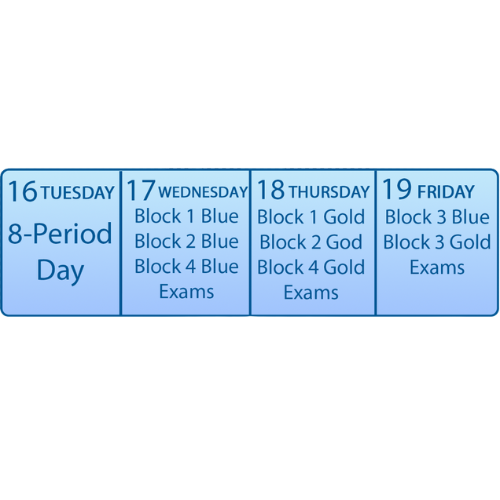

The new changes to the FAFSA caused a variety of problems among South seniors, College Counselor Kalene Heaton, explained. One issue was the timeline shift, as this year’s form was released on Jan. 1, in comparison to the previous release date of Oct. 1, Heaton said. Because of this delay, students will be receiving financial aid packages in April instead of February, scarily close to the May 1 date by which students must commit to a school, Heaton added.

“Colleges will be unable to receive the data [from FAFSA] until around [the middle of] March,” Heaton said. “[FAFSA’s shifted deadline] puts seniors in a really tight spot because they want to see where the finances shake out before they say yes to a school.”

Another difficulty deals with glitches of the form, leading to families having no accessibility, Heaton said. For parents who do not have a social security number, they are no longer able to create an FSA ID. Despite the department acknowledging this issue, there is no solution, adding to the stress of approaching deadlines, Heaton added.

“Typically, you are able to log back in and [information] can be updated in any way,” Heaton said. “For students that complete the new FAFSA and submit it, they are unable to make any corrections, currently.”

Senior Katie Allen is among the many seniors having trouble accessing the form. After accidentally entering her social security number incorrectly, the Social Security Office believed her to be stealing someone’s identity, and locked her out of the FAFSA.

“I call the FSA every day, and every day they hang up on me,” Allen said. “I don’t know what I am supposed to do because I still cannot get into it. It stresses me out because I need to have this done for college, and it is a graduation requirement.”

Many resources, including workshops and assistance, are offered at South to help guide students and parents alike through filling out the form, Heaton said. On Jan. 25, South held a FAFSA workshop in which 50 families attended to try to successfully complete the form, Heaton added. Additionally, individual FAFSA assistance appointments are running through the College and Career Center, Heaton said.

“We have seen a lot of students coming [for help], which is awesome,” Heaton said.

Despite the negatives associated with the new FAFSA, one positive is that more students will be eligible to receive the Federal Pell Grant, the largest federal grant program offered to undergraduates from low-income households, the FSA reported. Now, the grant will link qualifications to family size, the federal poverty level, incarcerated students, and high schools that closed, the FSA reported. Even with this increased eligibility, it does not offset the rising prices of attending college, Heaton added. For families that are right outside of the threshold of qualifying for need-based aid, they are hit the hardest, and left with the least to help afford a four-year institution tuition, Heaton added.

“[The FAFSA] is intended to help students offset the cost of attending college,” Heaton said. “I am encouraged by that, now, more students will be eligible [for the Grant].”